Article II 4/2025 - NORWEGIAN SEAFOOD ANCHORS GROWTH IN ASIA THROUGH LOCALISATION AND TRUST

In 2024, Southeast Asia and Taiwan emerged as critical growth regions for Norwegian seafood exports, with total exports reaching a record value of NOK 9.47 billion, a 12% increase compared to the previous year. This growth reflects not only rising demand but the cumulative impact of long-term investment by the Norwegian Seafood Council (NSC) in building awareness, trust, and cultural relevance across markets. Rather than taking a one-size-fits-all approach, NSC has focused on understanding the dynamics of consumer behaviour in the region, localising its messaging, adapting its promotional strategies, and strengthening partnerships with retailers, importers, and foodservice stakeholders.

Rising demand in Southeast Asia

Seeking certification

The pole and line method is considered to have a low environmental impact. It is a highly selective way to fish with low bycatch rates, and skipjack are targeted at the surface of the water so there are no interactions with the seabed.

However, the fishery had to consider the wider impacts of all its activities before it could achieve MSC certification. To become certified, fisheries must demonstrate to independent, third-party assessors that target stocks are healthy, environmental impacts are minimised, and that effective management measures are in place.

“We thought we would have no problem trying to get certified, but it was not that easy at the beginning. There were lots of things we needed to improve that we had not considered – including where our bait came from,” Adnan Ali, former Managing Director of tuna processor Horizon, explains.

A key area of improvement related to the sustainability of the reef fish populations used as bait. As a condition of MSC certification, the fishery was required to show its impact on the bait fish and develop a management plan to ensure the stock was not being overexploited. To achieve this, fishers were trained to gather data on the amount of bait caught, different species and locations, and record interactions with endangered species.

A global standard for sustainability and food safety

The Norwegian Seafood Council plays a central role in bringing Norwegian seafood to global consumers. Established by the Ministry of Trade, Industry and Fisheries, NSC is responsible for reputation management, market development, and demand generation for the “Seafood from Norway” branding. With offices in 13 countries and operations in over 20, NSC is uniquely positioned to observe and respond to shifting global consumer behaviour. The Council’s Southeast Asia operations are headed from Bangkok and includes activities in the whole region. The work is rooted in data. Each year, it surveys over 60 000 consumers across more than 20 markets to understand seafood perceptions, emerging needs, and evolving preferences. This extensive insight informs everything from in-store messaging to digital campaigns, recipe content, and trade engagement. Key markets in Asia include Thailand, Vietnam, Taiwan and Malaysia.

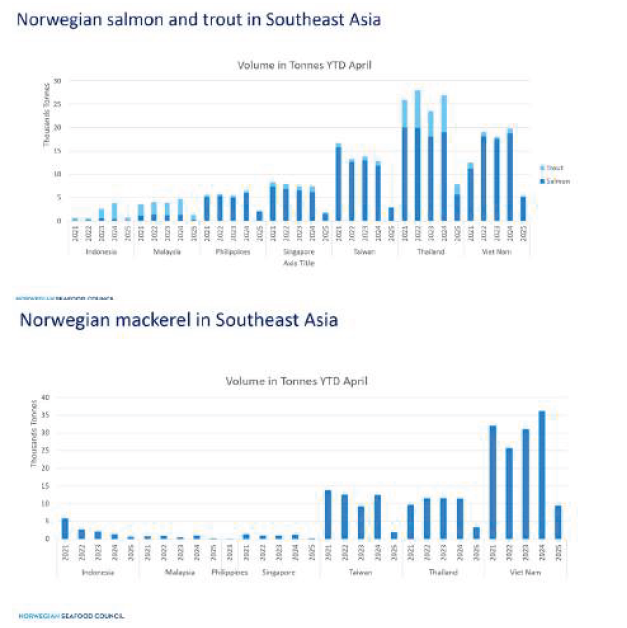

Thailand

Thailand’s performance in 2024 reflected a deepening and dynamic connection with Norwegian seafood. Total exports to the country increased by 13% in value, reaching NOK 3.06 billion, while volume rose by 8% to 42 500 tonnes. Of this total, a significant 91% comprised fresh salmonids, underscoring Thai consumers’ strong preference for fresh, high-quality seafood. Salmon remained the leading species, with exports of fresh salmonids totalling 24 649 tonnes, a 13% increase in volume and a 12% rise in value compared to the previous year.

However, the demand for Norwegian seafood in Thailand extends beyond salmon alone. Fjord trout, valued for its richer flavour and deeper colour, has gained traction among chefs and premium retailers seeking differentiation in high-end dining and sashimi offerings. In 2024, Norwegian trout exports to Thailand reached an estimated value of approximately NOK 540 million, with consistent growth driven by increased menu integration and retail availability.

Mackerel, on the other hand, has carved out a distinct niche in the Thai market due to its affordability, high oil content, and compatibility with traditional Thai cooking methods such as grilling and frying. The species saw continued demand across wet markets and modern trade outlets, positioning it as a staple for both home cooks and restaurants.

Japanese cuisine fuels market expansion

The rising popularity of Japanese cuisine has undoubtedly fuelled the increase in demand for raw seafood. With more than 5 700 Japanese restaurants operating across the country, the appetite for high-grade salmon and trout remains robust. Yet, NSC recognised early on that Thailand’s potential went beyond the foodservice sector. Growing consumer interest in health, nutrition, and culinary experimentation has opened new pathways into the home-cooking segment, where seafood is no longer reserved for special occasions but is becoming a regular feature in weekly meals.

Norwegian Thai Taste Campaign with Yaya Sperbund

In 2024, NSC launched a wide-reaching campaign to promote Norwegian salmon, trout, and mackerel. At the heart of it was Thai celebrity Urassaya 'Yaya' Sperbund.

Trade and future growth

Thailand’s seafood imports from Norway are also supported by a favourable trade environment. The recently signed free trade agreement under the European Free Trade Association (EFTA) is expected to reduce tariffs on Norwegian seafood exports to Thailand over the coming years. Given that seafood already accounts for more than half of Norway’s total exports to Thailand, the agreement is likely to further lower barriers and encourage trade. With Thai market growth projected at 16% by 2030, opportunities remain strong. In 2024, salmon exports alone were worth NOK 1.9 billion.

“Salmon Saturday” and future campaigns

In 2025, through consumer research, NSC discovered that 46% of Thai consumers already ate salmon at home on Saturdays, and 73% of those preferred it for dinner. This led to the creation of the “Salmon Saturday” campaign, launched in April 2025. By aligning promotions with this cultural habit and encouraging families to maintain salmon as a centrepiece in their Saturday dinners, NSC created a perception that strengthened loyalty and preference.

In September 2025, NSC will launch its highlight event, the “Seafood from Norway” festival, to raise greater awareness of Norwegian seafood; educate through first-hand experiences using immersive storytelling about aquaculture in Norway; engage with consumers to build branding preference; as well as celebrate the 120 years of diplomatic relations between Thailand and Norway.

Vietnam: From processor to premium market

Vietnam offers a different but equally important story. Traditionally a processing destination, Vietnam is now emerging as a premium seafood consumer market – it is in fact, one of the few countries where seafood consumption is increasing. According to the Food and Agriculture Organization of the United Nations (FAO), per capita seafood consumption is around 34 kg of fish and shellfish per year in Vietnam, which is an increase of 18 percent in 10 years. In that period, the Vietnamese middle class has also doubled. This means that the willingness to pay for fresh, tasty seafood of high quality is constantly increasing.

Norway exports live king crab, frozen brown crab, salmon and mackerel to Vietnam. It is the latter two that make up the largest volume. The total export value of salmon and mackerel has more than doubled since 2020, ending at almost NOK 2.7 billion in 2024. In the same period, the export volume of mackerel and salmon increased from 38 000 tonnes to 72 000 tonnes – also a doubling. While the Norwegian salmon is primarily consumed in the country, most of the Norwegian Atlantic mackerel is processed and forwarded to Japan.

In 2024, the Council partnered with leading retailers and food service groups to promote Norwegian salmon in Hanoi and Ho Chi Minh City. A highlight of the year was the major promotional events and the official “Seafood from Norway” signing ceremony with WinMart and the Golden Gate Group, the owner of many Japanese restaurant brands. This strategic collaboration aimed to boost consumer preference for Norwegian salmon. NSC also collaborated to launch menu campaigns featuring Norwegian salmon with iSUSHi and Shogun, bringing the product directly to Vietnamese diners.

Additionally, a high-profile promotional event with Royal Seafood spotlighted Norwegian king crab, further expanding the range of premium Norwegian seafood available in the market. Another highlight aimed at increasing consumers’ interests in Norwegian salmon was a cooking contest with an Erling Haaland theme and a media partnership with Dan Tri Newspaper, one of highest-ranking news sites in Vietnam.

In early 2025, salmon exports to Vietnam grew by 16% in volume and 7% in value while rising trout exports and improved cold chain infrastructure further enhanced consumer trust. NSC also participated in the first-ever Food and Hospitality Exhibition in Hanoi alongside 14 Norwegian exporters.

Efforts to build brand familiarity have included in-store promotions, visual merchandising, and participation in training programs like the Norwegian Salmon Academy, which equip chefs and food professionals with the skills to handle Norwegian seafood. These initiatives reflect the Council’s long-term commitment to raising standards and promoting sustainable, high-quality seafood in Vietnam.

Taiwan: Market diversification

Taiwan presents another compelling case of market diversification. Norwegian seafood exports to Taiwan totalled NOK 1.7 billion in 2024, a modest increase of 1% in value and 11% in volume to 28 200 tonnes. With 96% of all salmonids imported fresh in Taiwan, the market maintains high expectations for quality and traceability.

Taiwan’s imports of salmonids have been stable at around 27 000 tonnes per annum in recent years, mostly comprising fresh Atlantic salmon. However, due to rising prices for Atlantic salmon, the cheaper Chilean Pacific salmon has taken some of the market. At the same time, while Atlantic salmon imports dipped slightly by 8% in 2024, Norwegian mackerel surged by 35% in volume and 59% in value. This shift reflects Taiwan’s preference for affordable, flavourful fish suitable for grilling and bento-style dishes.

Promoting health and convenience

The Council has adapted its messaging to emphasise mackerel’s health benefits and compatibility with local recipes. Social media campaigns and point of sale (POS) materials have highlighted Norwegian mackerel in lunchboxes and family meals, resonating with health-conscious parents and time-pressed professionals. Trout is also gaining a foothold in the retail channel, positioned as a versatile alternative to salmon in sashimi, poke bowls and steamed dishes.

Additionally, influencers played an active role in the campaign by introducing simple, home-style recipes and promoting Japanese restaurant partner’s menus using Norwegian seafood. These integrated efforts contributed to increased consumer familiarity with Norwegian seafood and strengthened its positioning in the Taiwanese market. Business partners also reported an average sales increase of 10% in 2024.

Taiwan is a well-established market for Norwegian mackerel and salmon. Norwegian mackerel continues to enjoy strong brand recognition due to its seasonal quality and high fat content. While lower quotas and rising prices pose challenges, consumer preference remains strong. In 2025, promotional efforts in Taiwan will continue to work towards enhancing brand visibility and reinforcing the Norwegian origin of the seafood, focusing on salmon and mackerel. Taiwan stands out in that less fresh salmon is sold for raw consumption in supermarkets compared to other Asian countries. Instead, store sales are dominated by fresh salmon cutlets that are used for grilling and frying. But in line with the sushi wave, the demand for sushi, sashimi and easy-to-make products is increasing, especially among young people. Herein lies the potential for further growth.

Malaysia

Malaysia embraces fjord trout

Malaysia’s fondness for premium fjord trout drove a 17% increase in imports from Norway in 2024. The NSC supported this growth through partnerships with top importers and retailers, launching over 100 roadshows across major cities. These initiatives promoted the fish’s Norwegian origin and boosted the visibility of the Seafood from Norway trademark, supported by in-store giveaways, social media campaigns, and key opinion leaders (KOL)-led cooking demonstrations.

In 2025, NSC continues to elevate fjord trout with renewed campaigns across major cities, again featuring in-store promotions, giveaways, and influencer collaborations to build trust and drive sales.

A tailored strategy for Southeast Asia

Sustainability is central to the Seafood from Norway message. Norwegian aquaculture leads global rankings like the Coller FAIRR Index, thanks to practices such as zero antibiotic use, coastal management, and feed traceability. The Seafood from Norway mark assures consumers of responsible sourcing—an increasingly important factor, especially among younger Asians.

Looking ahead, the Norwegian Seafood Council aims to deepen its presence in Asia by aligning with local food culture, promoting transparency, and using data-driven insights. Through chef collaborations, retail campaigns and digital storytelling, the Council is turning Norwegian seafood into a trusted part of everyday meals while shaping expectations around quality and sustainability.

In summary, there is a rising demand for Norwegian seafood in Southeast Asia, particularly in Thailand, and the success of promotional campaigns like the “Norwegian Thai Taste” campaign featuring Thai celebrity Urassaya 'Yaya' Sperbund with localised messaging to build trust. Fundamental to the increasing demand is the importance of sustainability and food safety in Norwegian seafood production, which has helped establish Norway as a global benchmark for seafood in the industry.